Columbus Ohio Business Income Tax . We strongly recommend you file and pay with our new online tax portal, crisp. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. It is quick, secure and convenient! The majority of ohio business entities must pay the ohio corporate income tax on their business earnings. City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. Registration information as well as forms are available online (opens in a new window) or at. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. First, register with the ohio secretary of state.

from www.templateroller.com

We strongly recommend you file and pay with our new online tax portal, crisp. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. Registration information as well as forms are available online (opens in a new window) or at. It is quick, secure and convenient! In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. The majority of ohio business entities must pay the ohio corporate income tax on their business earnings. City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. First, register with the ohio secretary of state.

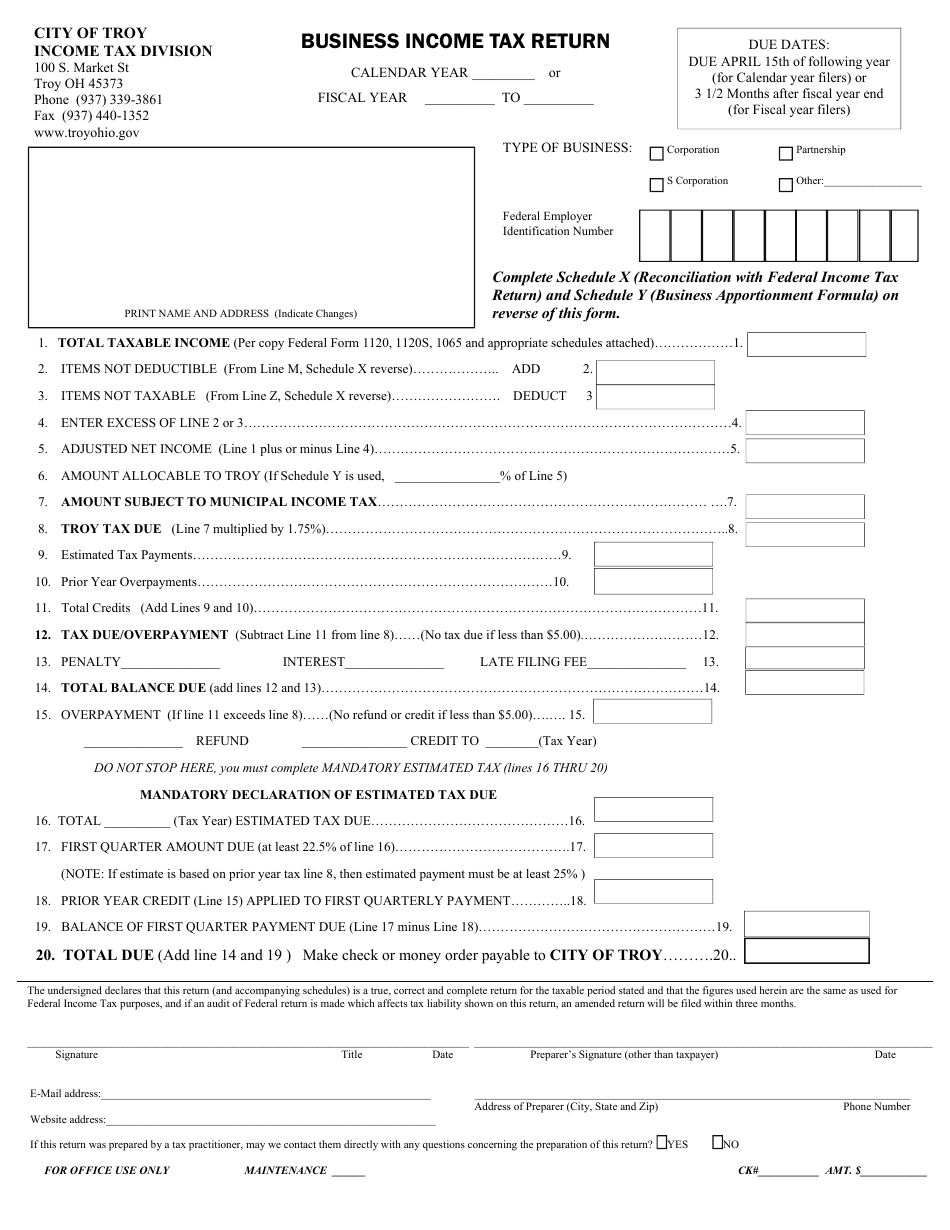

City of Troy, Ohio Business Tax Return Fill Out, Sign Online

Columbus Ohio Business Income Tax First, register with the ohio secretary of state. Registration information as well as forms are available online (opens in a new window) or at. The majority of ohio business entities must pay the ohio corporate income tax on their business earnings. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. We strongly recommend you file and pay with our new online tax portal, crisp. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. It is quick, secure and convenient! City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. First, register with the ohio secretary of state.

From www.neilsberg.com

Columbus, OH Median Household By Race 2024 Update Neilsberg Columbus Ohio Business Income Tax We strongly recommend you file and pay with our new online tax portal, crisp. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. Registration information as well as forms are available online (opens in a new window) or at. First, register with. Columbus Ohio Business Income Tax.

From www.templateroller.com

Form RB Fill Out, Sign Online and Download Printable PDF, City of Columbus Ohio Business Income Tax First, register with the ohio secretary of state. We strongly recommend you file and pay with our new online tax portal, crisp. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. City auditor megan kilgore announced that residents and businesses can file their columbus city. Columbus Ohio Business Income Tax.

From www.facebook.com

MJAA Tax Service Columbus OH Columbus Ohio Business Income Tax Registration information as well as forms are available online (opens in a new window) or at. First, register with the ohio secretary of state. It is quick, secure and convenient! For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. We strongly recommend you file and pay. Columbus Ohio Business Income Tax.

From www.formsbank.com

Business Tax Questionnaire Form State Of Ohio printable pdf Columbus Ohio Business Income Tax City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. It is quick, secure and convenient! For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. We strongly recommend you file and pay with our new online tax. Columbus Ohio Business Income Tax.

From www.facebook.com

1 800 Tax Accounting Columbus OH Columbus Ohio Business Income Tax The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. The majority of ohio business entities must pay the ohio corporate income tax. Columbus Ohio Business Income Tax.

From www.city-data.com

Columbus, Ohio (OH) map, earnings map, and wages data Columbus Ohio Business Income Tax The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. City auditor megan kilgore announced that residents and businesses. Columbus Ohio Business Income Tax.

From www.cleveland.com

State, local tax deductions most popular in Ohio's suburban areas; see Columbus Ohio Business Income Tax For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. Registration information as well as forms are available online (opens in a new window) or at. City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. In both. Columbus Ohio Business Income Tax.

From www.youtube.com

What is Columbus Ohio tax rate? YouTube Columbus Ohio Business Income Tax It is quick, secure and convenient! The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. Registration information as well as forms are available online (opens in a new window) or at. We strongly recommend you file and pay with our new online tax portal, crisp.. Columbus Ohio Business Income Tax.

From www.formsbank.com

Business Tax Return Form 2001 City Of Massillon, Ohio Columbus Ohio Business Income Tax Registration information as well as forms are available online (opens in a new window) or at. First, register with the ohio secretary of state. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. We strongly recommend you file and pay with our new online tax. Columbus Ohio Business Income Tax.

From www.waveapps.com

The Ultimate Guide to Ohio Business Taxes Columbus Ohio Business Income Tax For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. We strongly recommend you file and pay with our new online tax portal, crisp. City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. In both cases, beginning. Columbus Ohio Business Income Tax.

From www.formsbank.com

City Of Columbus Tax Division printable pdf download Columbus Ohio Business Income Tax City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. We strongly recommend you file and pay with our new online tax portal, crisp. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. The columbus income tax. Columbus Ohio Business Income Tax.

From www.formsbank.com

Business Tax City Of Trotword, Ohio printable pdf download Columbus Ohio Business Income Tax City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. First, register with the ohio secretary of state. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. Registration information as well as forms. Columbus Ohio Business Income Tax.

From www.templateroller.com

Form KBR1040 2022 Fill Out, Sign Online and Download Fillable PDF Columbus Ohio Business Income Tax We strongly recommend you file and pay with our new online tax portal, crisp. First, register with the ohio secretary of state. It is quick, secure and convenient! In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. The columbus income tax division. Columbus Ohio Business Income Tax.

From www.templateroller.com

Form KBR1040 2022 Fill Out, Sign Online and Download Fillable PDF Columbus Ohio Business Income Tax It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. Registration information as well as forms are available online (opens in a new. Columbus Ohio Business Income Tax.

From www.insureon.com

Columbus, OH Business Insurance 2024 General Liability & More Insureon Columbus Ohio Business Income Tax City auditor megan kilgore announced that residents and businesses can file their columbus city taxes on a new online. For the purpose of filing the required business and withholding tax returns, please register for an account on our new website, the columbus. First, register with the ohio secretary of state. In both cases, beginning in tax year 2023*, if the. Columbus Ohio Business Income Tax.

From facebook.com

Cardinal Tax & Financial Services Columbus OH Columbus Ohio Business Income Tax In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. Registration information as well as forms are available online (opens in a new window) or at. The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income. Columbus Ohio Business Income Tax.

From www.formsbank.com

Ohio Tax Return Form City Of Canton 2004 printable pdf download Columbus Ohio Business Income Tax The columbus income tax division provides the service of collection, audit, and enforcement of the 2.5% income tax for the city of columbus, as. Registration information as well as forms are available online (opens in a new window) or at. The majority of ohio business entities must pay the ohio corporate income tax on their business earnings. It is quick,. Columbus Ohio Business Income Tax.

From www.creditkarma.com

Ohio Tax Rates Things to Know Credit Karma Columbus Ohio Business Income Tax We strongly recommend you file and pay with our new online tax portal, crisp. In both cases, beginning in tax year 2023*, if the income on which the tax is based qualifies as business income under ohio law, the tax added. For the purpose of filing the required business and withholding tax returns, please register for an account on our. Columbus Ohio Business Income Tax.